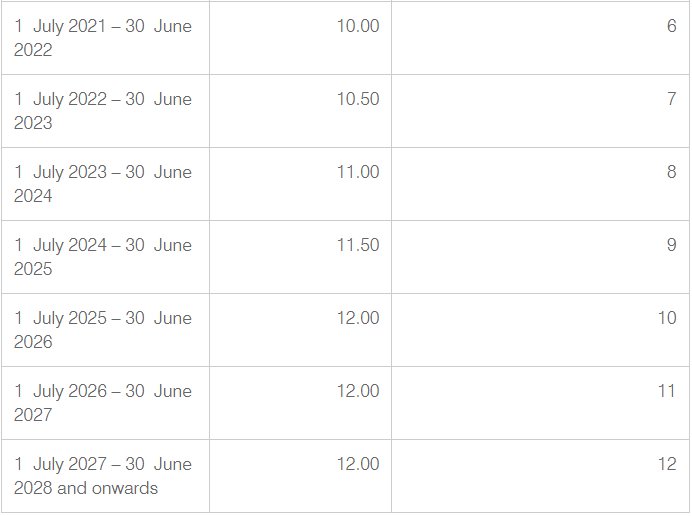

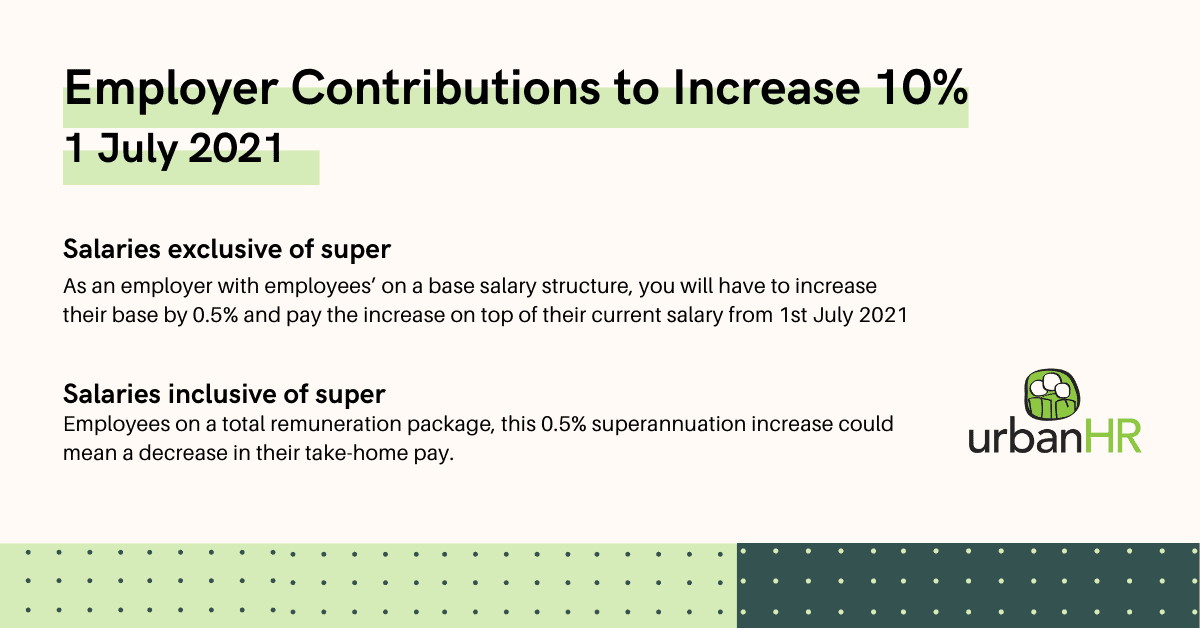

Employer Contributions to Increase to 10.5% – 1 July 2022

From 1 July 2022, the current superannuation rate of 10% will increase to 10.5%. This increase is a statutory increase and therefore compliance is mandatory.

The rate of the superannuation guarantee is currently set to rise each year by 0.5% until it reaches 12%.

Salaries exclusive of super

- As an employer with employees’ on a base salary structure, you will have to increase their base by 0.5% and pay the increase on top of their current salary from 1st July 2021;

- There may be some exceptions to this general position which will be dependent on the exact wording in the instrument and if an offset clause operates to allow for absorption of this amount into the overall remuneration package.

Salaries inclusive of super

- Here is where it may get a little tricky! Employees on a total remuneration package, this 0.5% superannuation increase could mean a decrease in their take-home pay. As such, we are expecting to see most employers will electing this option, and pass on this additional cost by increasing their employees’ super and decreasing their cash component.

- Please feel free to reach out to ensure there are no other provisions in your employment contracts that make this option unavailable.

Your contributions for each employee are required to be paid on at least a quarterly basis.

For further information on due dates, please head to the ATO website.

As always, should you need some help, please get in touch.

Facebook

Twitter

LinkedIn

Email

Print